September 2025 Market Update: Electronic Components

Posted in Diamond News

The European electronic components market is showing the first signs of recovery since 2023. Distributor shipments are increasing again, and lead times are beginning to rise.

Globally, artificial intelligence (AI) demand remains the primary growth driver, with defence and aerospace markets also fuelling demand. Meanwhile, prices for raw materials and freight are falling, offering some relief for manufacturers.

Semiconductor Lead Times

Key Supplier Updates

Analog Devices (ADI)

-Lead times extending from 10 – 26 weeks in some categories.

-Pricing to remain relatively stable.

Texas Instruments (TI)

-Prices rising +6% – +98%, averaging +38%

-Lead Times ranging from 18-22 weeks and remaining stable.

Vishay (VSH)

-Lead Times rising sharply with wide lead times of 26-54 weeks.

-Prices remaining stable.

ST Microelectronics (STM)

-Lead times extending for most STM components, with 18–30 weeks for the most affected components, Discrete and MCU.

-Workforce cuts may slow production further.

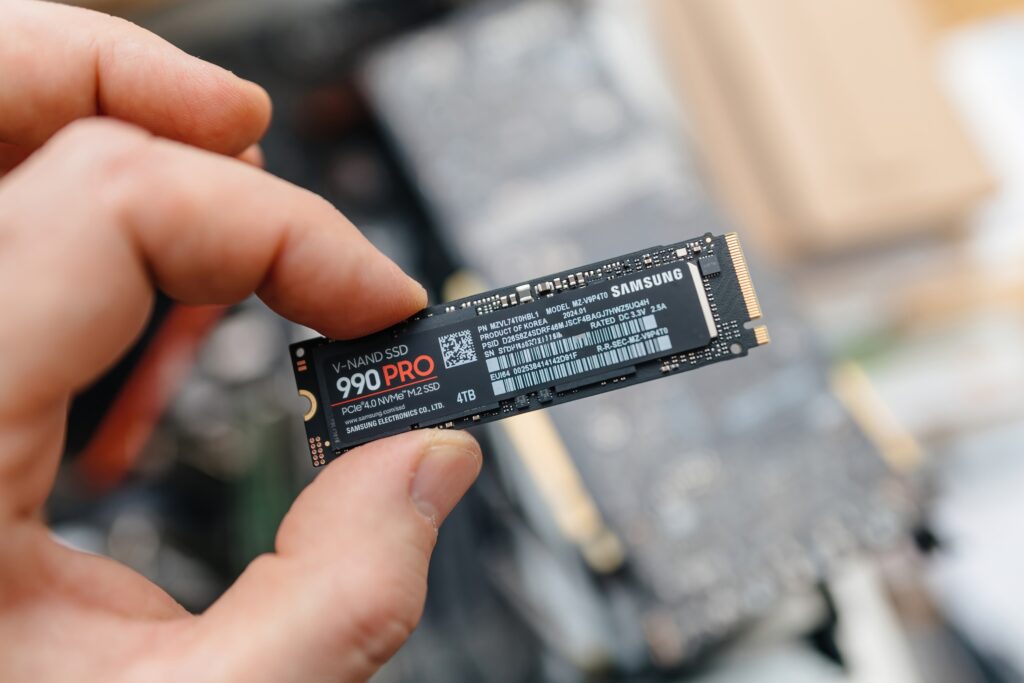

Micron (MU)

-Lead Times extending with +21 Weeks forecasted. DDR3 and DDR4 are most impacted, with Major Suppliers pulling out of older technology.

-DDR5 prices and lead times are affected, but to a lesser extent.

Microchip (MCHP)

-Lead Times extending across several categories, with Data Converters (6–35 weeks), Interface (6–20 weeks), and Switched Voltage Regulators (8–28 weeks) showing upward pressure.

-High-End Op Amps (6–24 weeks) remain stable, though still lengthy.

-Prices remain steady across all segments.

ON Semiconductor (ON)

-Lead Times mostly stable, though Switched Voltage Regulators (12–40 weeks) are extending further.

-Interface (10–28 weeks), Op Amps (Commodities 10–20 weeks; High-End 14–26 weeks), and Voltage Regulators (10–32 weeks) are holding steady.

-Pricing remains flat across all product lines.

Memory Prices Surge

Memory pricing is under significant pressure. With major manufacturers ending DDR4 production, prices in September are expected to be 56–69% higher than at the end of March. DDR5 prices are less affected but are still increasing by 3–8% in Q2 and Q3.

Act now to protect your Q4 production schedule. Through component kitting, Diamond Electronics can source and store the memory you need at today’s price in a ready-to-use kit.

Tariff Threat and Supply Chain Impact

Chip tariffs remain a major concern for the global electronics supply chain. While Apple has secured exemptions, a 100% tariff rate is still expected for many imports, with US chipmakers exempt.

TSMC and Samsung will also avoid tariffs thanks to their US manufacturing sites, while the European Union has agreed to a 15% rate. These changes will disrupt supply chains, extend lead times, and raise prices due to tariffs and production relocation.

Diamond Electronics can help you navigate these challenges through alternative sourcing and by finding parts from suppliers least affected by tariffs.

Protect Your Q4 and 2026 Production

At Diamond Electronics, we are constantly monitoring lead times, pricing trends, and global supply pressures. Rising prices and longer lead times mean today’s decisions protect tomorrow’s production.

Plan ahead—secure your components now to safeguard your Q4 and 2026 production schedules.

Call us on: +44 (0)1477 500450

Email us: sales@diamondelec.co.uk