The electronics supply chain has seen much disruption over the past 12 months. A period of uncertainty due to COVID 19, then a sudden spike in requirements has now left the market struggling to meet demand. To ensure we can assist customers to navigate through the market challenges, we monitor manufacturer lead time updates, and our team highlight potential problems that are likely to affect our customer’s requirements. Below we highlight some of the current issues and potential factors that could affect recovery.

Factors contributing to the supply chain disruption

At the start of the pandemic many manufacturers reduced production due to lowered demand, uncertainty surrounding the economic landscape potential reductions household disposable income. However, demand soon increase beyond pre pandemic levels driven by the requirements created by home working.

Electronic Parts and Raw Materials Overview:

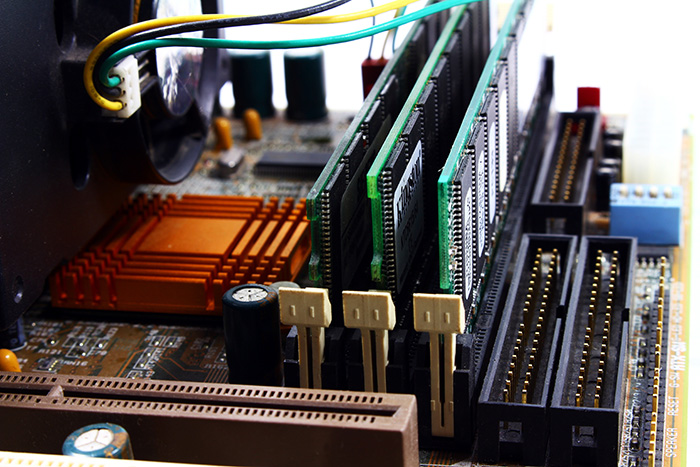

- Semiconductors: many devices are now facing lead times of around 25+ weeks. In some cases, order books are closed for 2021.

- Market prices: The price of Gold and Platinum has increased due to strikes and COVID outbreaks. Ruthenium, a by-product of Platinum which is used in resistive paste has also seen significant increases.

- Reduced manufacturing capacity in the Far East due to COVID health and safety regulations, alongside numerous COVID outbreaks has led to factory closures.

- Shipping: Increased cost of freight services and a reduced capacity has affected both lead times and cost of goods.

- Far East Factories, enforced closures: Power disruption in key manufacturing locations has reduced output by up to 40%.

Impacts of Supply Chain Disruption

Product shortages have inevitably led to prices increases. Car manufacturers reportedly leaving out or changing features of designs because of the shortages. Consumer electronics such as TVs, mobile devices, and games consoles are adversely affected by shortages and shipping delays.

Customers trying to add Safety stock inventory plus double ordering have similarly contributed to supply shortages. Many manufacturers and distributors have now initiated Non-Cancellable/No Return (NCNR) policies on all orders.

Outlook for recovery

Many manufacturing companies are predicting it will be mid 2022 before we start to see improvements in lead times. Potential Allocation strategies from semiconductor manufacturers will lead to prioritising parts for certain sectors.

Potentially reduced consumer demand for electronics due to society opening up from the current restrictions, may start to ease some supply pressure later in 2021 and in to 2022. Future COVID 19 outbreaks/lockdowns may see this demand increase again.

Looking further ahead, US & Europe based Technology companies are also looking at bringing manufacturing capacity closer to home to become less reliant on the Far East. Realistically the timescale for reaching this change is 24-36 months.